Designing Payment Flows That Help Users Build Credit, Not Destroy It

67% of Americans can't cover a $400 emergency—but traditional credit cards only offer one option when users struggle: miss payments and destroy credit. I designed Possible Finance's credit card payment system to break this cycle, creating an installment plan conversion feature that helped 3,000 pilot users maintain their credit scores during financial difficulty while achieving 89% customer satisfaction.

Key contributions:

Designed complete onboarding and payment setup flow encouraging healthy financial behaviors

Created installment plan conversion experience (unique product differentiator)

Established payment education and transparency patterns

Collaborated with PM and engineering to balance user needs with regulatory constraints

My Role & Approach

The Challenge

Possible Finance had a successful payday loan alternative, but wanted to expand with a credit card that would actually help users build credit, not destroy it. The key innovation: the ability to convert outstanding balances into installment plans, preventing missed payments and credit score damage when users face financial difficulty. I needed to design payment flows that make this complex financial product simple, transparent, and build healthy financial habits by default.

My Approach

As Senior Product Designer, I owned the payment flow experience end-to-end (onboarding, installment conversion, rescheduling) and collaborated with another designer to co-design the dashboard, ensuring seamless integration between payment initiation and ongoing management.

Designed the complete payment experience from approval through ongoing management:

Payment setup and autopay configuration

Installment plan conversion flows (unique product differentiator)

Payment rescheduling and modification

Education and transparency patterns

Collaborated with PM to define flexible payment requirements, balancing user needs with regulatory constraints and business objectives

Established design patterns for financial education, transparency, and user control that extended beyond payment flows to become company standards

Validated through a pilot program, gathering feedback from 3,000 customers to refine the experience before broader rollout

Payment Experience

Onboarding (Setting Up for Success)

The first interaction sets the tone for the entire relationship. I designed the onboarding to celebrate, educate, and establish healthy defaults.

Key Design Decisions

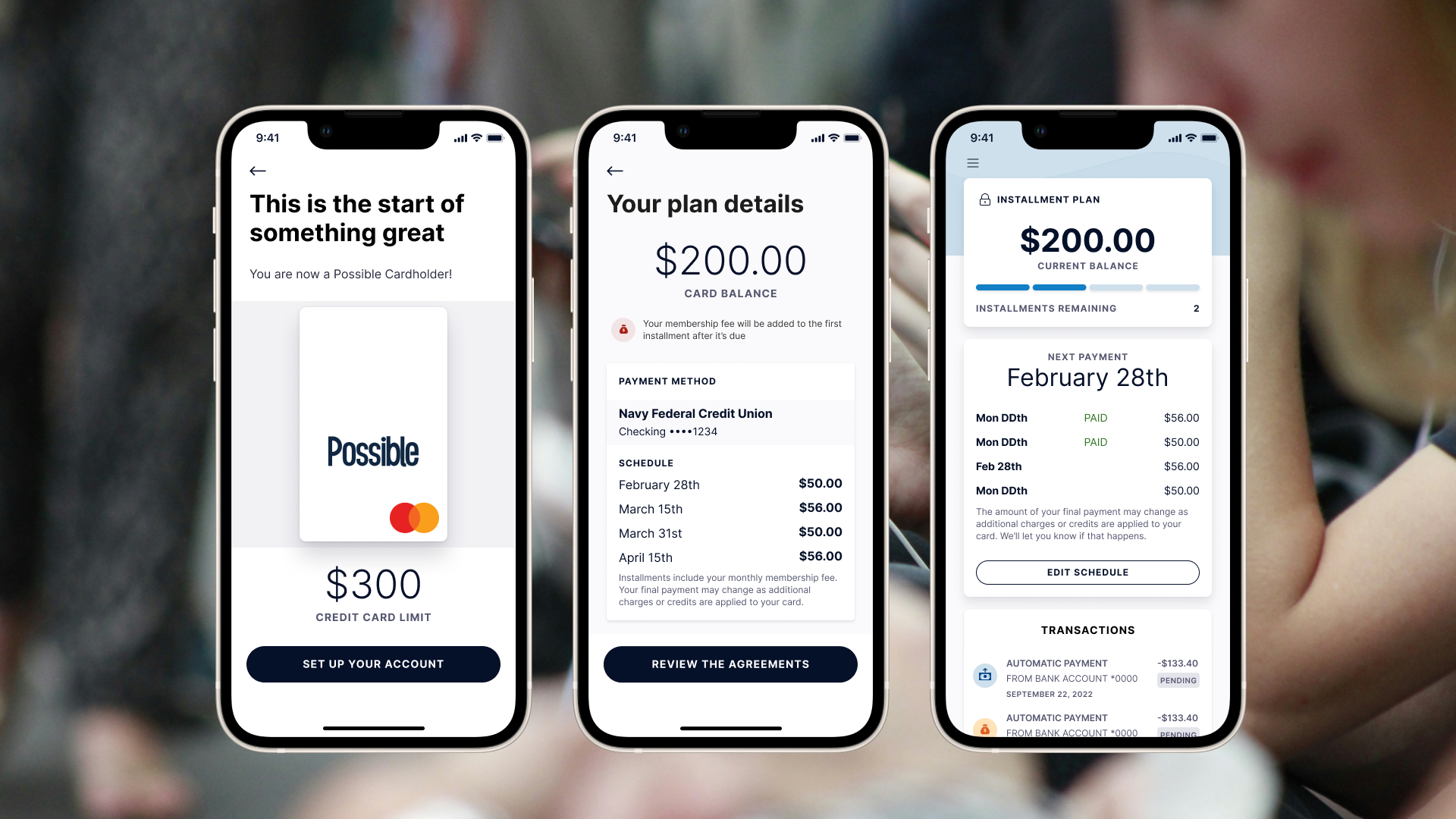

Celebrate the approval: The "This is the start of something great" screen frames approval positively. Users see their $300 credit limit with a visual card mockup, making the opportunity tangible and exciting rather than transactional.

Educate upfront: Rather than assuming financial literacy, the "How payments work" screen breaks down the payment cycle into 4 clear steps with icons:

Your payment will be automatically paid

Your payment will show as scheduled

Your payment clears 2-3 business days after

Your balance will update showing new amount

Why this matters: Preventing confusion is cheaper than handling support tickets. Users who understand the system make better decisions.

Encourage healthy defaults

The autopay setup screen makes autopay the default path, not an optional toggle. This is a critical design decision.

Key elements

Clear heading: "Set up autopay"

Explanation of frequency: "Your full balance will be withdrawn from the connected account on a bi-weekly basis"

Connected account clearly shown: Navy Federal Credit Union Checking ••••1234 in a prominent card

Membership fee transparency: Warning with icon explaining "Your Possible Card membership fee for the current month will be charged as soon as you accept the card agreements"

Upcoming autopayments listed: Wednesday December 15th, Friday December 30th, Friday January 14th (shows three upcoming payment dates)

Primary action: "REVIEW THE AGREEMENTS" button

Escape hatch: Small text at bottom: "If autopay doesn't work for you, contact us for alternatives" with "Contact us" link

Design principle

Autopay is the default, not optional. This isn't a toggle users can skip. The design makes the healthy choice the primary path while still offering an alternative for those who truly need it.

Why default autopay matters

On-time payments are critical for building credit

Users who set up autopay are less likely to miss payments

Bi-weekly schedule aligns with common paycheck timing

Showing three upcoming dates builds trust and sets expectations

Transparency through design

Connected bank account shown clearly with last 4 digits

Membership fee called out explicitly before user commits

Three upcoming payment dates visible (not just "next payment")

Alternative contact option at bottom for edge cases

Installment Plan Conversion

The Problem

Traditional credit cards have one option when you're struggling financially: miss payments and damage your credit, or somehow find money you don't have.

The Solution

When users face financial difficulty, they can:

Pause new charges on the card

Convert the outstanding balance into fixed installment payments

Maintain their credit score by continuing on-time payments through the plan

This is what sets Possible Card apart from other credit cards on the market.

Why this matters

67% of Americans can't cover a $400 emergency. This feature provides a safety net that actually helps users, not penalizes them.

The Conversion Flow

I designed the conversion to be fast and frictionless. Users who need help shouldn't have to jump through hoops.

Step 1: Educate first

Before converting their balance, users see exactly how the installment plan works.

Three key messages with icons:

Your card will be locked - Don't forget to update any automatic payments using your card

You pay your full balance over 4 payments - Any pending charges or credits applied to the last payment, with flexible dates up to a 31-day grace period

Once your balance is paid your card is ready to use again - After final payment is processed

Design principle

Users need to understand the trade-offs (locked card, 4-payment structure, grace period) before making this decision. Education reduces buyer's remorse and support burden.

Step 2: Review the complete plan

The plan details screen shows everything users need to know before committing. Dates are automatically set starting from the next payment date - there’s no date selection required.

Key elements

Card balance prominently displayed: $200.00

Membership fee notice with warning icon: "Your membership fee will be added to the first installment after it's due"

Payment method confirmation: Navy Federal Credit Union Checking ••••1234

Complete schedule showing 4 payments:

February 28th: $50.00

March 15th: $56.00

March 31st: $50.00

April 15th: $56.00

Transparency note: "Installments include your monthly membership fee. Your final payment may change as additional charges or credits are applied to your card."

Primary action: "Review the agreements"

Why auto-schedule works

Removes decision paralysis - users don't have to pick dates

Starts immediately from next payment due date

Maintains payment rhythm they're already expecting

Users can edit dates later if needed

Design principle

Make the default path the easiest path. Users in financial stress don't need more decisions - they need immediate relief with sensible defaults.

Step 3: Informed consent

The agreements modal ensures informed consent through progressive commitment.

Design decisions

Modal overlay focuses attention

Close button (X) in the top right allows exit

Scrollable terms text

Explicit checkbox: "I understand and accept the terms of the installment plan agreement above."

Slide-to-agree interaction (not just a button tap)

Action requires both the checkbox AND slide completion

Why progressive commitment

Combining a checkbox with slide-to-agree makes accidental acceptance nearly impossible while still being frictionless for users who've read and understood the terms.

Making the feature discoverable

The dashboard serves as the ongoing home for payment management. When users need flexibility, the installment plan conversion is right where they need it.

Key design decisions

Prominent but not pushy: The "PAY OVER TIME" button sits below the current balance and standard payment options (Pay Now, Edit Autopay). It's clearly visible for users who need it, but it doesn't feel like we're pushing users toward debt conversion when they don't need it.

Context-appropriate placement: Users see their current balance first ($200.00), understand their payment status (next payment February 28th), and then have the flexibility option available. The button appears in a natural spot in the information hierarchy.

Clear labeling: "PAY OVER TIME" immediately communicates what the feature does without financial jargon like "installment plan conversion" or "hardship program." The language is simple and benefit-focused.

Design principle

The best safety net is one you can find when you need it. The feature needed to be discoverable without feeling like a trap or penalty.

Step 4: Confirmation and peace of mind

The confirmation screen provides closure and sets clear expectations.

Key elements

Celebratory illustration (calendar with coins) reinforces positive action

Specific payment amount: $50.00

Exact start date: "Monday, February 28th"

Payment frequency stated: "Will be paid every two weeks"

Important deadline notice: "You can change or cancel this payment until 7:30pm PST on October 14th. It may take up to 4 days for your available balance to refresh."

Simple "OK" button to dismiss

Design principle

Financial decisions are stressful. Confirmation screens should reduce anxiety by clearly stating:

What just happened ($50.00 bi-weekly starting February 28th)

When it takes effect (immediately, but 4 days for balance refresh)

How to undo it (cancel by October 14th at 7:30 pm PST)

Preventing confusion

When users have an active installment plan, their card is locked to prevent new charges. If they forget and try to use the card, they receive an immediate SMS notification.

Key design decisions

Proactive communication

Rather than leaving users confused about a declined transaction, the system sends an immediate text message explaining why the card was declined and what they can do about it.

Clear, actionable messaging

States the situation clearly: "Your Possible Card is paused"

Explains why: "unavailable for purchases until you complete your repayment plan"

Provides action: "Tap the link..." to review plan details

Reduces support burden

This single notification prevents countless "why was my card declined?" support tickets. Users get their answer immediately, with a path to see their payment schedule.

Design principle

Anticipate moments of confusion and provide answers before users have to ask. A declined transaction is stressful - immediate context reduces anxiety and maintains trust.

Ongoing Plan Management

Once users have an active installment plan, they need the ability to adjust it when life changes.

Showing progress and providing control

The dashboard transforms once a plan is active, showing users where they are and giving them control to adjust if needed.

Key elements

"INSTALLMENT PLAN" header with lock icon (reminder card is locked)

Current balance: $200.00

Progress indicator: "Installments remaining: 2"

Next payment prominently displayed: February 28th

Payment history showing completed payments marked "PAID"

Upcoming payments with dates and amounts

"EDIT SCHEDULE" button for making changes

Transparency note about final payment adjustments

Design principle

An active plan isn't a trap. Users should always know where they stand and have clear paths to make adjustments if their circumstances change.

Rescheduling when needed

Users can edit individual payment dates through a simple calendar interface.

Design decisions

Month/year navigation with arrows

Full calendar grid showing available dates

Selected date highlighted (28th)

Clear note below calendar: "Your payment is due on or before Month DDth"

"Save change" button to confirm

Why allow editing

Financial situations change. Paychecks get delayed. Unexpected expenses happen. Giving users control to reschedule prevents missed payments.

Guided decisions

Warning states help users understand the implications of their date choices without being patronizing.

Two levels of guidance

Level 1 - Soft warning: "That date is a little far away"

Message: "This won't impact your credit score but will negatively impact your ability to borrow from Possible Finance in the future."

Primary action: "I understand"

Secondary action: "Pick a different date"

Level 2 - Strong recommendation: "That date is pretty far away"

Message: "If you want to pay on this day, your credit score and ability to reloan with us will be negatively impacted. To select this date anyway, you'll need to contact us."

Recommendation: "We recommend selecting a date that's nearer if possible."

Primary action: "Pick a date that's nearer"

Secondary action: "Contact us"

Design principle

Guide users toward healthy choices while respecting their autonomy. The first warning allows them to proceed with understanding. The second requires contact, creating a speed bump for potentially harmful decisions while still offering the option through human conversation.

Reschedule confirmation

When users modify their payment schedule, they receive clear confirmation.

Key elements

Celebratory illustration (calendar with coins)

Heading: "Your payment has been rescheduled"

Specific amount rescheduled: "$50.00"

New date: "Monday, February 28th"

Two clear next actions:

Primary: "Back to dashboard"

Secondary: "Reschedule another"

Design principle

Every action gets clear confirmation. Even schedule changes need acknowledgment to reduce user anxiety about whether the change "took."

Design Principles

Through this work, I established four key principles for Possible's payment experiences

Financial Transparency

Every screen shows exactly what users are committing to. Amounts, dates, terms, and fees are always visible. No hidden surprises.

Examples in practice

Membership fees called out with warning icons before commitment

Complete payment schedules shown with specific dates and amounts

Final payment adjustment possibility explained upfront

Cancellation deadlines stated clearly

Healthy Defaults

Autopay isn't buried in settings. It's encouraged as the primary path. Good design can guide users toward behaviors that benefit them (on-time payments build credit).

Examples in practice

Autopay is the default onboarding path, not optional

Bi-weekly payments align with common paycheck timing

Installment plan auto-schedules from next payment date (no decision paralysis)

Warning system guides users toward nearer payment dates

Progressive commitment (checkbox + slide) prevents accidental acceptance

Education Through Design

Rather than assuming financial literacy, educational screens build understanding before users make decisions. Preventing mistakes is better than handling their consequences.

Examples in practice

"How autopay works" explains the 4-step cycle before users commit

"How Pay Over Time works" covers card locking, payment structure, and grace period

Warning modals explain credit score implications of date choices

Proactive notifications prevent confusion when card is paused

Empathy in Crisis

The installment plan exists for when users struggle financially. The design treats this moment with dignity, presenting it as a tool for staying on track, not a penalty for failure.

Examples in practice

Feature is called "Pay Over Time" not "Hardship Program"

Dashboard entry is a clear button, not buried in settings

Education explains benefits (maintaining credit) not just constraints (locked card)

Grace period of 31 days provides genuine flexibility

Warning messages are informative, not judgmental

SMS notifications explain declined transactions without shame

Impact & Outcomes

Through this work, I established four key principles for Possible's payment experiences

Pilot Launch Success

Shipped to production

3,000-customer pilot program validated the payment experience

89% customer satisfaction rate with card dashboard and payment flows

Installment plan feature confirmed as key product differentiator

Strategic Impact for Possible

Market differentiation

Installment plan conversion is unique in the credit card market

Addresses documented user need (67% of Americans can't cover $400 emergency)

Positions Possible as customer-first financial services provider

Provides foundation for expanding card product features

Product foundation established

Created reusable payment flow patterns for future products

Developed scalable design system components for financial transparency

Validated educational approach through pilot metrics

Proved flexible payment model works within regulatory compliance

Established notification patterns for proactive user communication

User Value Delivered

Credit building enabled

Installment plan conversion designed to prevent credit score damage during financial stress

Transparent scheduling allowed users to align payments with income patterns

Default autopay encouraged on-time payment behavior

Flexible rescheduling accommodated changing circumstances

Financial clarity achieved

Upfront education designed to reduce confusion about payment mechanics

Clear payment amounts and dates visible before commitment

Installment plan provided control during difficult financial moments

No hidden fees - membership costs called out explicitly

Proactive notifications explained card status changes